Hurricane season in south Florida can be a stressful time for homeowners. The threat of high winds, flying debris, and devastating damage looms large, making preparations crucial for protecting your home and loved ones. One of the most effective ways to safeguard your property and potentially save money in the long run is by installing impact windows. In this comprehensive guide, we’ll explore the impact of these windows on your home’s safety, energy efficiency, and financial well-being.

What Are Impact Windows and Why Are They Important?

Impact windows, also known as hurricane windows or impact-resistant windows, are specially designed to withstand severe weather conditions, including high winds and flying debris. Unlike traditional windows, which can shatter upon impact, these windows are reinforced with layers of impact-resistant glass and a sturdy frame, making them much more durable and resilient.

Installing impact windows is essential for homeowners in hurricane-prone areas like Florida, where the risk of property damage during storms is high. Not only do these windows provide superior protection against wind and debris, but they also enhance home safety and peace of mind for residents.

Impact Windows in South Florida: Specific Considerations

Florida, particularly South Florida, is a high-risk area for hurricanes. As a result, homeowners in Florida must consider installing impact-resistant windows to protect their homes. The state of Florida offers rebates and federal tax credits to make the purchase and installation of these windows more affordable. Homeowners should look for windows that meet specific standards to ensure they qualify for these benefits.

How Do Impact Windows Impact Your Energy Costs?

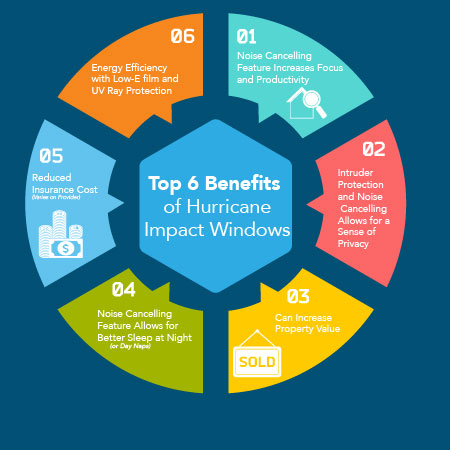

In addition to their primary function of protecting your home during hurricanes, impact windows can also lead to significant energy savings throughout the year. By improving insulation and reducing air leakage, these windows help maintain a consistent indoor temperature, reducing the workload on your heating and cooling systems.

The increased energy efficiency of impact windows can result in lower utility bills year-round, providing homeowners with tangible cost savings. Moreover, some impact windows meet specific criteria for energy efficiency improvements, making them eligible for tax credits and rebates, further offsetting the initial investment.

Understanding the Financial Benefits of Impact Windows

While the initial cost of installing impact windows may seem daunting, it’s essential to consider the long-term financial benefits they offer. Not only can these windows potentially lower your insurance premiums by providing added protection against hurricanes, but they can also increase the value of your home.

Moreover, the federal government has introduced tax credits for homeowners who invest in energy-efficient improvements, including impact windows. By claiming these credits on your tax return using Form 5695, you can receive a credit of up to 30% of the cost of the windows, with a maximum credit limit of $200 per window.

Eligibility and Requirements for Tax Credits

To qualify for tax credits for impact windows, homeowners must ensure that the windows meet specific criteria set forth by the government. This includes meeting Energy Star standards for energy efficiency and being installed by a reputable contractor.

It’s also crucial to keep detailed records of the window installation and associated costs, as well as any documentation required by the IRS. Consulting with a tax professional can help ensure that you take full advantage of available tax credits and deductions, maximizing your savings.

Maximizing Savings with Impact Windows

In summary, investing in impact windows for your home in South Florida can yield substantial financial benefits, especially during hurricane season. By providing superior protection against storms, enhancing energy efficiency, and offering Hurricane windows tax credits, these windows offer a comprehensive solution for homeowners looking to safeguard their property and save money in the process.

Frequently Asked Questions

How do I know if my windows are ENERGY STAR qualified?

Check for the ENERGY STAR label on your windows, which indicates they meet energy efficiency standards. You can also verify by looking up the manufacturer’s details and the window model on the ENERGY STAR website.

Is there a tax credit for installing hurricane windows in Florida?

Florida doesn’t offer a specific tax credit for hurricane windows, but federal tax credits for energy-efficient home improvements might apply if the windows meet ENERGY STAR requirements.

How to Claim Tax Credits for Hurricane Impact Windows?

Homeowners can claim a tax credit for hurricane impact windows by providing proof of purchase and installation, ensuring the windows meet energy efficiency improvement criteria, and completing the necessary tax forms. It’s essential to consult with a tax professional to accurately claim these credits and maximize potential savings.

How Can Hurricane Windows Affect Your Homeowners Insurance?

Installing hurricane windows can lower your homeowner’s insurance premiums. Insurers often offer discounts for these windows due to their enhanced protection against storm damage, reducing the likelihood of costly claims.

Contact us Today

If you’re considering upgrading your home with impact windows, don’t wait until the next hurricane season. Contact us today to schedule a consultation with our team of experts. We’ll assess your home’s needs, provide personalized recommendations, and help you take advantage of available incentives and financing options.

Don’t gamble with your home’s safety and financial security. Call us at 786-807-6776 to learn more about how impact windows can benefit your home and family. Protect your investment and enjoy peace of mind with impact windows from Hurricane Home Improvement.

Key Takeaways:

- Impact windows are crucial for protecting your home during hurricane season in Florida.

- These windows can lead to significant energy savings and may be eligible for tax credits.

- Homeowners should ensure that their impact windows meet specific criteria to qualify for financial incentives.